About Us

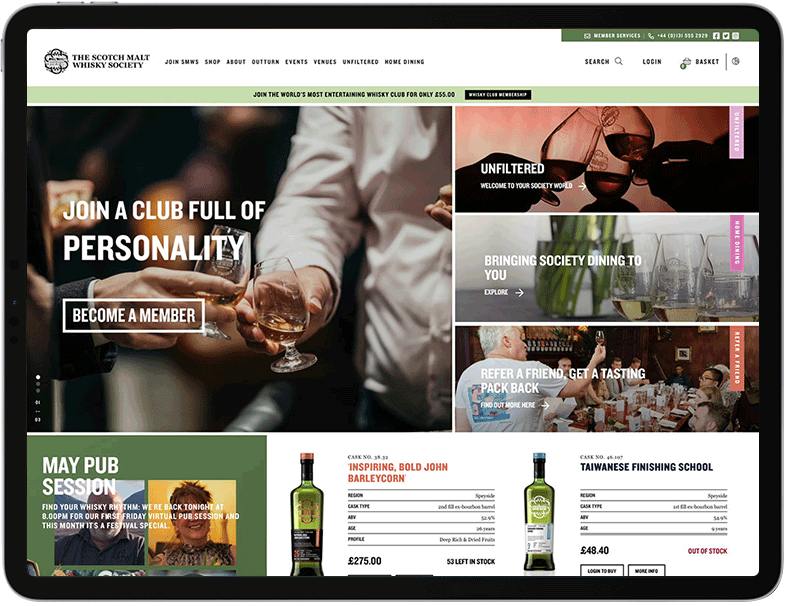

Based in Edinburgh, the Artisanal Spirits Company (ASC) owns The Scotch Malt Whisky Society (SMWS), Single Cask Nation (SCN) and J.G. Thomson (JGT), as well as operating a cask storage, bottling and logistics facility in Scotland.

Owning over 17,000 casks primarily comprising Single Malt Scotch Whisky, ASC’s stock includes outstanding whisky (and other spirits) from 150 different distilleries across 20 countries which is sold both as individual bottles and whole casks.

With proven e-commerce reach and a growing family of brands, ASC is building a portfolio of limited-edition and small-batch whisky and other spirits brands for a global movement of discerning consumers – delivering revenue of c.£23 million in FY23 with over 80% of revenue generated online, predominantly from outside the UK, with presence in the other key global whisky markets including USA, China, Europe, Japan, Australia and Taiwan.

ASC has a pioneering business model, a substantial and growing addressable market presenting a long-term global growth opportunity and a strong and resilient business primed to deliver growth.

Our Culture

These values are what we stand for. It’s how we hold ourselves to account and how we depend on each other. This is how we live and breathe. We are responsible for this.

Respect

We treat all people with respect in any situation. We are a company that puts this at the forefront of our culture and our member first mindset. It’s how we welcome anyone into our world and sets it as a cornerstone to build on. We offer a way to communicate openly and honestly.

Innovative

Being innovative is in our DNA. Our founder Pip Hills was the ultimate innovator as he pursued his ambition to bring single cask whisky to our members. We bring this passion for creativity and innovation to everything we do, whether it is to the job or apply to ourselves. We will create and innovate to develop and grow as people and together grow the business.

Grit & Determination

We know that some challenges are tough and will take monumental effort, but we will all do our best to achieve our shared goals as a team. We agree there is a ‘right to challenge’ each other and that we do so in a positive and supportive way, so that in the end we are rewarded with success as a team in which we have all played our part.

Unique

We embrace how we are all different – our diversity is our strength. We benefit from the fact that the sum of our team is greater than the individual parts. We are inclusive and we lean in. Our ‘uniqueness’ makes us stronger – and, all together as one, unique.

Progressive

As we encourage our members to constantly explore new flavours in the whisky and spirits we offer and try new experiences, we encourage ourselves to explore new opportunities and learning. We all actively participate in creating an environment that stimulates this and thrives.

Growth Strategy

The Group’s growth strategy to achieve sustainable revenue growth and profitability is based on four key pillars:

Developing the membership base and geographic expansion

During the Covid-19 pandemic, the Group, in common with broader trends across the consumer sector, experienced a pronounced shift in consumer preferences towards online shopping. The Directors intend to exploit this structural change by building upon the Group’s existing online sales channels and focusing on digital member recruitment initiatives. Additionally, the Group will look to enhance the membership value proposition of The Scotch Malt Whisky Society in order to increase member retention.

The Directors acknowledge that there is a significantly larger addressable market for the Group’s unique range of premium spirits outside the UK. In recent years, the Group has established operations in key international whisky markets and the Directors will seek to make further investments in high growth or emerging spirits markets.

The Company will also explore opportunities to expand the number of physical SMWS venues, on a selective basis, both in the UK and potentially overseas, provided that the Board is confident of generating an acceptable return on capital invested.

Enhance e-commerce channels

Much of the Group’s recent growth can be attributed to the success of its online platform. The Directors intend to make further investments in the e-commerce platform in the UK whilst rolling out this proposition to other territories. They also expect to replace the current CRM systems with an upgraded and integrated CRM platform equipped with the tools to facilitate more targeted marketing campaigns. Additionally, by continually developing online content and events, such as virtual tastings, they anticipate improved purchasing experiences and higher levels of member engagement.

Increasing margins and value creation

The Group generated a gross margin of 63.6 per cent. in the financial year ended 31 December 2022. The Directors believe that there is scope to improve this through a combination of financial and operational initiatives. Buying greater quantities of younger spirits, which are cheaper than aged stocks, will reduce the input cost per bottle. It is also expected that insourcing elements of the Group’s current supply chain could provide cost effective solutions which will also reduce stock movements. The Group also intends to increase the proportion of sherry cask maturation which the Directors believe is increasingly in demand and will result in higher priced products, thus further enhancing the value creation process.

New brands

The Directors intend to extend the Company’s addressable market by launching new brands, each of which will be an independent concept with a differentiated product line, with J.G. Thomson launched in November 2021. The Company’s successful historical expansion of SMWS provides a blueprint for future growth.

Investment Case

Unique, award-winning products

SMWS is focused on providing premium single cask spirits. With an average whisky cask yielding around 250 bottles each time, each release is by its very nature a limited edition with exclusive characteristics.

The Group’s objective is to bring together spirits from some of the world’s best spirits producers, add value by managing the maturation process and provide exclusive access to a vast and unique range of outstanding single cask Scotch malt whisky and other spirits to The Scotch Malt Whisky Society’s global membership.

In the last three years, SMWS’ Scotch malt whisky and other spirits have been recognised with a total of almost 200 awards from seven of the leading industry bodies including the ‘Best in Show’ win at the Luxury Masters, the Scotch Whisky Masters, top awards in the International Wine and Spirits Competition, the International Spirits Challenge, the Ultimate Spirits Challenge and the San Francisco World Spirits Competition.

Proven track record of growth

The Company has a track record of consistent growth. Between FY16 and FY19, revenues almost doubled from £7.6 million to £14.6 million, representing a CAGR of 24%. In FY22 revenue growth was 19%.

Loyal and growing membership base

At the heart of SMWS’ unique market positioning is its subscription-based membership model. A key driver of the Group’s financial performance has been The Scotch Malt Whisky Society’s expanding global membership, which has grown at a CAGR of 7%. since December 2016. There are now approximately 40,000 members of The Scotch Malt Whisky Society across the globe.

At December 2022, average UK member retention was at 77%. in relation to all members and at 85% for those members renewing after more than one year of membership. Since 2002, the average membership tenure for UK and European members is nine years. Membership loyalty not only provides a strong platform from which to recruit new members and develop brand awareness, but also generates a predictable recurring revenue stream in the form of annual membership fees.

Creating value and high margins

In contrast to conventional spirits retailers and resellers, the Group engages in both spirit and cask selection and in active management of the maturation process, which accounts for a significant proportion of the flavour profile of the finished product, in the same manner as a distillery.

However, the Group is not a primary producer of spirits and so is able to create award-winning products without the burden of the additional capital investment required to operate a distillery. This value-added proposition combined with an e-commerce led business (over 86% of sales online and over 95% of sales made through D2C channels in 2020) generates high margins. During FY20, the average selling price for a 70cl bottle (excluding VAT) was £76 which generated approximately £49 of gross profit per bottle (excluding US tariff costs).

The Directors believe that there are a number of opportunities to further improve the margin profile of the business, such as purchasing younger stock, sherry cask finishing and in-sourcing some elements of the Group’s supply chain.

Strong e-commerce metrics

SMWS’ D2C subscription membership model and heavy concentration of online sales affords the opportunity to provide a rich suite of customer and financial data which is used to inform both sales and marketing activity, membership recruitment and strategic business development planning. The Scotch Malt Whisky Society exhibits strong membership metrics. Key metrics for the financial year ended 31 December 2020 were as follows:

Average annual

revenue per member

Global member

retention rate

Average lifetime

value (‘LTV’)

Average member

acquisition cost (‘CPA’)*

Average LTV/CPA

ratio

*CPA has been estimated using a dataset of around 4,500 new UK members recruited during 2019 and 2020 which the Directors consider to be a good proxy for CPA across the global membership.

International footprint

The Group has successfully developed The Scotch Malt Whisky Society brand internationally and it currently has approximately 40,000 members spread across 30 countries. International members (being those resident outside of the UK) comprised 58% of the total December 2022 membership base, yet represented 66% of the Group’s total FY22 sales and therefore represent the most profitable demographic.

Importantly, SMWS has a presence across a number of key international whisky markets including the US, China and Japan as well as a number of major European markets such as France, Germany and Sweden.

Quality assurance

Both the selection of cask spirit from distilleries and the maturation process are carried out under the supervision of the Group’s Spirits Director with a view to ensuring that the final outturn represents the finest quality spirits and flavour profiles.

Vast stock holding

As at 31 December 2022, the Group had over 16,500 casks (equivalent to approximately 5 million standard 70cl bottles) of whisky in its reserves. To put this into context, this is approximately 26 times the volume sold during FY20.

This extensive stock base not only provides mitigation against any potential shortages of supply but, when coupled with SMWS’ approach of producing limited edition spirits, represents the potential for over 16,500 new product lines. This provides the Group with greater flexibility as it is not constrained by requirements to reproduce a particular age or flavour profile of spirit.

As at 31 December 2022, the Group’s spirit stock had a book value of £26.5 million (principally reflecting the initial purchase cost of the spirit but also including related costs such as storage). Management estimate, based on the FY22 average SMWS selling price (excluding VAT) per bottle of £99 and the 5 million standard bottle equivalent held in stock, that the implied retail value of the Group’s current spirit stock is approximately £493 million.

The Group maintains a complex spirit stock purchase model designed to balance stock purchases with projected demand from The Scotch Malt Whisky Society’s global membership over the long term. The model demonstrates that the Group already holds in stock a mix of spirits of the right age and flavour profiles to fulfil 95 per cent. of all future bottlings implicit within an illustrative growth scenario which builds to £40 million of revenue in 2026 (with headroom to continue to grow thereafter).

Our Board

Mark Hunter

Non-Executive Chair and Chair of the Nomination Committee

Mark was appointed as a Director on 24 March 2021.

Mark is the former President and CEO of MolsonCoors Brewing Company, a top five global brewer which had revenues of $10.8 billion, EBITDA of $2.45 billion and operations in over 25 markets globally as at 31 December 2018 (the end of the last accounting period before Mark retired). Mark retired from this role on 30 September 2019.

Mark is a non-executive director of TreeHouse Foods Inc, a US listed, leading manufacturer and distributor of private label packaged foods and beverages. Mark became a director in April 2020 and he is a member of the Audit Committee and the Long Range Planning Committee.

Mark has thirty-five years of marketing, sales and business unit leadership experience in North America, Europe and internationally. He has a track record of successful portfolio development, mergers and acquisitions, business integration and synergy delivery including the $12 billion acquisition of MillerCoors in the US and multiple brand acquisitions.

He is a people-orientated leader who believes passionately in clarity of purpose and ambition, aligning people to build enabling cultures and investing to build leadership capability, engagement and executional brilliance.

Paul Skipworth

Non-Executive Deputy Chair

Paul was appointed as a Director on 30 March 2015.

Paul started his career in corporate strategy consulting for ten years at LEK Consulting, and was then a Partner in an Asian based venture capital fund. Paul then spent 13 years building consumer brands and leading consumer companies globally at LVMH, working across consumer markets in Europe, Asia Pacific and the US. Paul was CEO and COO of Glenmorangie for five years, Regional Director Asia Pacific at Moet Hennessy, Senior Vice President of Strategy for Moet Hennessy and was a Partner in L Capital, LVMH’s sponsored private equity fund focused on the consumer sector.

Paul is a partner of Inverleith LLP.

Andrew Dane

Chief Executive Officer

Previously Finance Director of the Company since August 2020, Andrew has recently been appointed as Chief Executive Officer charged with driving the next phase of growth in line with ASC’s stated strategy.

Andrew previously worked for eight years at KPMG transaction services in London, Edinburgh and Toronto. During this time he worked on over 100 transactions covering multiple sectors, business sizes and geographies, including five Scottish capital markets transactions.

Prior to joining the Company, Andrew was the Finance Director at Argent Energy, the high growth UK biodiesel producer, from 2014 to 2020. He helped increase the size of Argent Energy’s business from around 65 employees and approximately £50 million turnover in 2014 (following their 2013 acquisition by Swire) to around 350 staff and approximately £350 million turnover in 2020.

Billy McCarter

Chief Financial Officer

Formerly Group Financial Controller, Billy was promoted to CFO and joined the Board in May 2023.

A qualified accountant with 16 years’ experience in Finance roles, Billy’s career has spanned a number of senior roles over the last 10 years, across various sized businesses; SME to multinational.

His understanding of whisky and the spirits industry is strong having spent 8 years within Diageo, leading the financial areas of the whisky business as well as a number of global projects, working with a number of markets and senior leaders to drive performance and productivity opportunities.

Mark Bedingham

Non-Executive Director

Mark was appointed as a Director on 1 September 2015.

Mark spent 20 years as the Regional Managing Director of Moet Hennessy Asia-Pacific, spearheading the Asia-Pacific growth of Moet Hennessy’s portfolio of luxury wines and spirits, including Veuve Clicquot, Moet et Chandon, Hennessy, Dom Perignon, Krug and Glenmorangie, turning the region into the largest contributor to the Moet Hennessy Group’s global turnover and profit. During this time, he also spent seven years as a non-executive director of the DFS Group. Part of the LVMH Group, DFS is a major travel retail company with a network of duty-free stores in major airports, as well as multibrand Galleria stores in key locations in Asia Pacific.

From 1997 to 2002, Mark was a director of Jardine Pacific, a subsidiary of Jardine Matheson.

More recently Mark is the vice chair and part of the founder investor group in Aspirational Consumer Lifestyle Corporation, a SPAC, which is listed on the NYSE and completed a business combination with Wheels Up, the leading private aviation company in the US. He has also been, until recently, Chairman of two hospitality and restaurant companies: CELAVI, based in Singapore with operations in Dubai, Tokyo and Taipei and Crystal Jade with over 60 outlets in Asia.

Gavin Hewitt (CMG)

Non-Executive Director

Gavin was appointed as a Director on 27 March 2015.

Gavin was the Chief Executive of the Scotch Whisky Association from October 2003 to December 2013. In November 2011 Gavin was elected as president of spiritsEUROPE (previously The European Spirits Organisation – CEPS) and held this role in conjunction with his position at the Scotch Whisky Association.

Gavin was appointed to the Advisory Board of Pure Scot Limited in 2014 and later appointed non-executive chairman of Bladnoch Distillery Limited (2015 to 2017). He currently is also non-executive chairman of Findr Ltd, a digital platform serving as a market-place for professional photographers.

Before working in the alcohol industry, Gavin served in Her Majesty’s Diplomatic Service (1970-2003) and between 1994 and 2003 was successively Her Majesty’s Ambassador to Croatia, Finland and Belgium acquiring considerable expertise in international and EU trade matters and a close connection with many large UK companies operating overseas. He is a Companion of the Order of St Michael and St George (CMG), a Master of the Quaich and a liveryman of the Worshipful Company of Distillers.

Lesley Jackson

Non-Executive Director and Chair of the Audit Committee

Lesley was appointed as a Director on 2 June 2021.

Lesley is a Chartered Accountant, having qualified with KPMG. She was the Group Chief Financial Officer for Stock Spirits PLC from 2011 to 2017, prior to which she held similar positions at William Grant & Sons, and at United Breweries (an Indian listed public company).

She is a non-executive director of Aberforth Split Level Income Trust plc and Devro plc (where she is appointed as the Senior Independent Director and Chair of the Audit Committee) and has served as a non-executive director of Trackwise Designs PLC (where she also chaired both the Audit and Remuneration Committees).

Lesley has extensive finance and business experience from her roles in international manufacturing businesses.

Helen Page

Non-Executive Director and Chair of the Remuneration Committee

Helen was appointed as a Director on 2 June 2021.

Helen has more than 25 years’ experience in marketing, innovation, consultancy and customer experience, including over 15 years in financial services. She joined Clydesdale Bank (now Virgin Money UK) in December 2012 and was part of the Executive Team to complete the IPO of the bank in 2016. Helen was Chief Brand Officer of the bank, and was chair of Virgin Money Giving until November 2021.

Prior to joining Virgin Money UK, Helen spent eight years at RBS in a number of roles. She became Managing Director for Marketing and Innovation and held responsibility for all UK brands across the Retail, Commercial and Corporate divisions.

Helen was also Head of Brand Marketing at Argos, where she re-launched the catalogue company as a retailer. Before Argos, Helen held a number of product and marketing roles at Abbey (now Santander), where she became Head of Marketing. She also has experience in research, consultancy and central government roles.

Our Leadership Team

Kai Ivalo

Spirits Director

Kai joined the Group on 1 December 2004.

Since 2009, Kai has been responsible for spirits sourcing, maturation/product development, selection and bottling. Prior to joining the Group Kai spent 14 years in advertising, direct marketing agencies and marketing roles. Kai has a Bachelor of Arts in Business Studies, a Diploma in Marketing.

Kai is a Keeper of the Quaich and a liveryman of the Worshipful Company of Distillers.

Anne Phillips

Marketing Director

Anne joined the Group on 16 January 2023.

With 20 years of UK, international and global marketing leadership experience in the drinks and whisky industry, Anne is the Group’s Marketing Director.

Prior to joining the Group, Anne was Global Marketing Manager for Laphroaig at Beam Suntory, and the Marketing manager for the Famous Grouse. Prior to that she held positions as the Head of Brand for Ardbeg, and at Scottish and Newcastle.

Anne was the Winner of a WACL Talent Award for 2021

Our People

People are at the heart of everything we do.

Our people drive our success.

From our humble beginnings in Leith, we have grown into a worldwide organisation with incredible teams across the globe. Our head office is still based at The Vaults in Leith where it all started, with a team of people working on our multi award-winning Spirits, in Production, Marketing & E-Commerce, Finance and Member Services. We also have an International team at HQ who work with teams in China, the US, Japan, Australia and more than 20 other countries globally.

Our members in Europe are looked after by passionate country managers and a network of more than forty brand ambassadors and we have another core team based at our spiritual home in Leith, Edinburgh. We are proud of the diversity and variety of people we work with, who bring exciting new ideas to explore, all enriching the culture in the company.

Apart from all this we have four fantastic Members’ Rooms in the UK, in Edinburgh, Leith, Glasgow and London, where teams provide entertainment to our members and guests. We pride ourselves on being experts on flavour and on whisky. We are educators, entertainers, hosts, providing a home from home. We include everyone and do so in a rather unconventional way.

And our partners are critical to how we operate. The people at the warehouses across Scotland where we store our whiskies, the distillery people around the world who supply us with wonderful casks, cooperages for our wood, the bottlers we work with, creative agencies, our Tasting Panel, all play a part in the alchemy of our craft.

Our Job Opportunities

Customer Service & Distribution Lead

Masterton Bond, Uddingston

Vacancy listed 04/09/2023

Customer Service & Distribution Coordinator

Masterton Bond, Uddingston